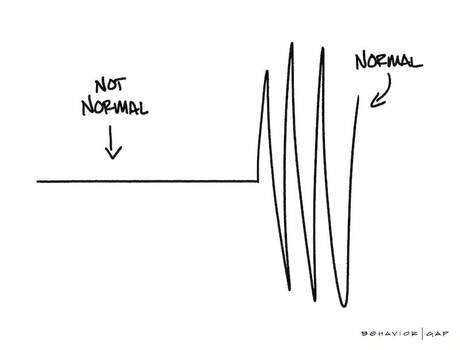

For this month’s Reality Check, we are revisiting a familiar topic: Volatility. We have become all too familiar with it as the world continues to deal with COVID-19. The way we perceive volatility is clouded by what we perceive as normal. Recency bias, the financial media and our own personal experiences with investing all tie into that perception of normal.

To better explain the normalcy of Volatility, we have decided to share a recent post from Carl Richards of the Behavior Gap. Carl has an ability to illustrate complex behavioral financial terms into very simple sketches and analogies. To read the full text from Carl, please visit his website.

If you any questions about this topic or wish to receive our Reality Check emails, please don’t hesitate to contact us.